Rethinking Life, Annuity and Benefits PAS Systems Part 4

Insurance Workflow and Process in the Age of Agentic AI

The Problem with Legacy Workflows

A fundamental component of insurance processing is workflow. Historically, older Policy Administration Systems (PAS) integrated workflows directly into the core system, providing full access to all capabilities and shared data. While initially efficient, this architecture became problematic as non-expert users required access to core functionalities, driving a demand for better customer experiences (CX) for both end-customers and internal staff.

This led to the rise of specialized vendors focused on extending, simplifying, or securing workflows outside the core admin system.

The drive to modern, deconstructed PAS demands a fresh perspective on workflow design, especially as Agentic AI becomes central to new operational strategies. Traditional workflows are often fragile, built on rigid, bespoke APIs or legacy screen scraping, making them susceptible to failure with any system change. A modern approach must embrace an ecosystem-centric architecture for end-to-end insurance processes.

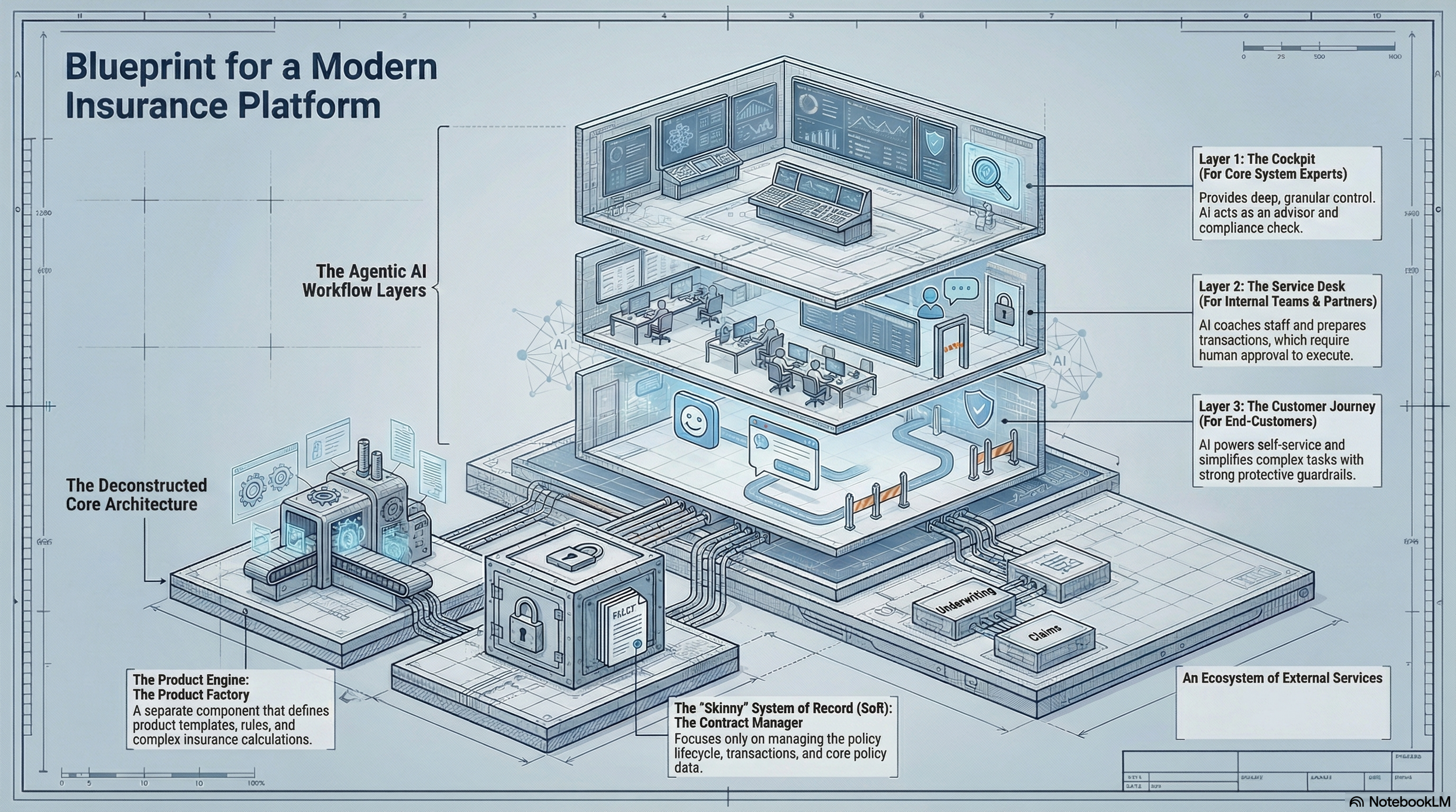

The Deconstructed Policy Administration Architecture

In a modern, deconstructed PAS, the System of Record (SOR) focuses primarily on transactions, not end-to-end workflows.

The expectation is that all external access—customer-facing, distribution-facing, and customer service group—will be mediated through an extended workflow layer that connects to the SOR, the calculation engine, and other contributing systems (e.g., billing and claims).

What makes this possible today are two trends that are making real headway in the insurance technology industry:

API-First Approach: Some innovative insurers are thinking the comprehensive end-to-end platform approach, looking to API-first for more flexibility and easier ecosystem access. A modular, API-first approach is critical for successful deconstruction.

Coreless Vendors: A growing number of insurance process vendors are adopting a "coreless" strategy. They intentionally avoid providing the SOR and calculation engine, choosing instead to own everything around it, treating the core functions as technical capabilities accessed via APIs. This model aligns perfectly with the deconstructed architecture.

Design by Chuck Johnston Rendering by NotebookLM